Streaming has overtaken linear TV in pretty much every conceivable way but one. And even that last one is dangling from the precipice.

Total revenues from streaming — now advertising revenue! — will overtake the revenues from pay TV subscriptions in the U.S. for the first time in the third quarter of 2024, according to Ampere Analysis. The two are trending in very different directions, and we’re maybe six months away from them crossing.

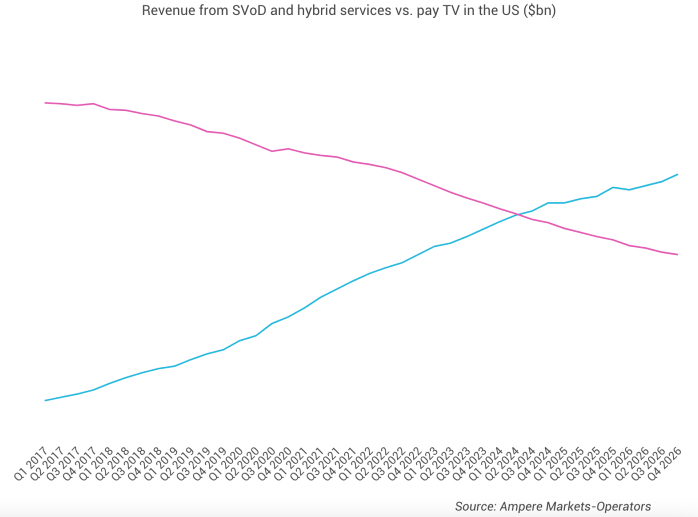

See the research company’s line graph below; pay TV (cable and satellite TV packages, basically) revenue is in pink and streaming revenue is in blue. (And no, we didn’t cut off any numbers on the Y axis — Ampere decided the point is best illustrated by the illustration itself, we guess.)

The above X axis begins in early 2017 because that’s the year that pay TV’s value peaked. By 2028, Ampere estimates, pay TV’s value will be half that peak.

Don’t conflate revenue for subscribers — that crossing happened back in 2016. Overall revenue lagged eight years because streaming ARPU (average revenue per user) is about one-tenth of pay TV’s.

Don’t feel too bad for streamers: They are making up for lost time. The early phases of the so-called streamers wars were a call to arms — adding subscribers and content at all costs. (And we do mean all costs.) Recent years have seen a shift to valuing profitability above all else. That pivot has increased revenue growth (profit equals revenue minus costs) through monthly price hikes and password-sharing crackdowns.

Additionally, the introduction of ad-supported tiers provided many streaming services with an additional revenue source. Amazon Prime Video joined the club in early 2024 and is expected to be a key contributor. Revenues from streaming ad tiers will pass $9 billion in the U.S. this year.

For linear TV, well, you see the chart. Ad revenue is directly tied to ratings and viewership — timber!

We’ve got more bad news for pay TV. Digital TV Research forecasts that by 2029, the U.S. will be down to 50.7 million pay-TV households; it was basically twice that in 2015.

SOURCE: IndieWire